nebraska sales tax rate

536 rows Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2There are a total of 337 local tax jurisdictions across the state. The Nebraska state sales and use tax rate is 55 055.

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

Nebraska has a statewide sales tax rate of 55 which has been in place since 1967.

. The Nebraska state sales and use tax rate is 55. The Nebraska sales tax rate is currently 55. The minimum combined 2022 sales tax rate for Omaha Nebraska is.

55 Nebraska Sales and Use Tax Rate Schedule For sales in excess of those covered by this schedule the tax may be computed by multiplying the sale by 055. Nebraska has a 550 percent state sales tax rate a max local sales tax rate of 250 percent and an average. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription.

Free Unlimited Searches Try Now. Local Sales and Use Tax Rates Effective April 1 2022 Dakota County and Gage County each impose a tax rate of 05. See the County Sales and Use Tax Rates section at the.

Fractions of a cent should. 31 rows The state sales tax rate in Nebraska is 5500. Nebraska sales tax details.

The state sales tax rate in Nebraska is 55 but you can customize this table as needed to reflect your applicable local sales tax rate. The minimum combined 2022 sales tax rate for Columbus Nebraska is 7. Ad Get Nebraska Tax Rate By Zip.

The Nebraska State Nebraska sales tax is 550 the same as the Nebraska state sales tax. This takes into account the rates on the state level county level city level and special level. The most populous county.

ArcGIS Web Application - Nebraska. Nebraska also has a 558 percent to 750 percent corporate income tax rate. With local taxes the total.

Exemptions from sales tax in Nebraska include groceries prescription medications and most medical equipment. Nebraska Sales Tax Rate The sales tax rate in Nebraska is 55. The Nebraska NE state sales tax rate is currently 55.

This is the total of state county and city sales tax rates. NE Sales Tax Calculator. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68.

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska. Printable PDF Nebraska Sales Tax Datasheet. Groceries are exempt from the Nebraska sales tax.

Counties and cities can charge an. Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75. While many other states allow counties and.

In addition local sales and use taxes can be set at 05 1 15 175 or 2 as adopted by city or county governments. Nebraska Sales Tax Rate Finder. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information.

This is the total of state county and city sales tax rates. Find your Nebraska combined state and local tax rate. The average cumulative sales tax rate in the state of Nebraska is 605.

Download all Nebraska sales tax rates by zip code. The Nebraska sales tax rate is currently. Nebraska sales tax rates vary.

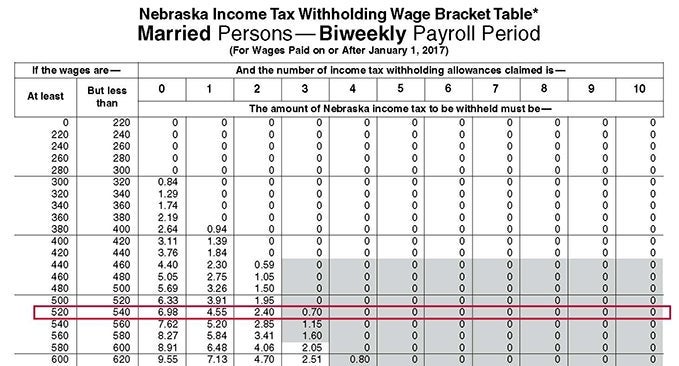

Nebraska Income Tax Ne State Tax Calculator Community Tax

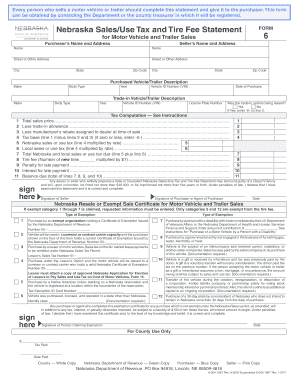

Form 6 In Nebraska State Fill Out And Sign Printable Pdf Template Signnow

Sales Tax Laws By State Ultimate Guide For Business Owners

Nebraska Income Tax Calculator Smartasset

Income Tax Withholding Faqs Nebraska Department Of Revenue

Form 6 Nebraska Fill Online Printable Fillable Blank Pdffiller

State Tax Levels In The United States Wikipedia

2021 Ne Dor Form 6 Fill Online Printable Fillable Blank Pdffiller

Death And Taxes Nebraska S Inheritance Tax

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

States With The Highest And Lowest Sales Taxes

Nebraska State Tax Things To Know Credit Karma